Webshop tooling: mice-nuts or fertile for venture companies?

Forecasting the total adressable market for webstore tooling, you get a market that grows rapidly but remains small in level terms. Despite this, it's an exciting opportunity for venture companies.

The Webstores Debate

One of the most interesting debates in mobile right now is over webstores. There is the “mice-nuts” view vs there “might be something vital here” view:

‘MICE NUTS’: Webshops help margins but don’t solve mobile’s core problem of struggling to grow its topline without cheap user acquisition. Webshop share of revenue is increasing but that’s not good; it is a mechanical byproduct of overall revenue falling → because in-app purchase revenue is falling → because UA whale monetisation was walloped by ATT. Without cheap whale targeting, mobile cannot replicate its astounding growth from 2009-2021.

‘MIGHT BE SOMETHING VITAL HERE’: it’s about the differential between the marginal gain from webstores evading app store fees vs the increased cost per impression from ATT. Right now that equation is in the red, but the more publishers can shift an in-app whale to a webstore whale, the higher your profits to be refunneled back into UA (and of course, webstores don’t have to out-grow ATT’s impact to be important in general).

If you think about the big mobile success stories recently, you’re looking at the record times it took for Monopoly Go and Whiteout Survival to hit $2bln in revenue alongside Royal Match eating King’s candy, growing its topline from $2 to $3bln. What all of these have in common is a) eye-watering capital deployed behind UA spend, b) higher monetisation rates than their competitors to drive a quicker return on ad spend which is then c) recycled back into UA to compound growth.

Webstores do not solve for the increased costs to acquire a user post ATT. Their role is in (b) and (c) - reducing variable costs relative to the topline to increase the operating cash flow that can be refunelled back into UA.

Looking at Webstores from the Tooling side

In that light, it’s also interesting to look at this from the perspective of B2B toolers rather than game publishers, as that’s been less discussed. Xsolla Mall and start-ups like Sanlo and Aghanim are trying to corner this nascent market of webstore tooling.

Much has been discussed about the economics for publishers (redirect in-app sales hit by the 30% store fee to webshops with fees of ~10% to bump margins) and Apple’s new rules that obey with the letter but not the spirit of anti-trust rulings, but there’s been less colour on the kind of numbers that are pushing startups to jump into this space.

Let’s start by estimating the TAM for webshop transaction tooling

All of these toolers want to upsell broader marketing solutions (more on this later), but it’s first necessary to estimate the the aggregate market size for webstore transactions.

There is no clear open-source data on the aggregate market so the numbers can’t be precise here. The aim is to find a reasonable ballpark in which the total addressable market currently sits.

Playtika (who are publicizing their webstore figures) reported that webstore revenue as a share of total revenue almost doubled from 13% in 2020 to 25% in 2023. Phillip Black also mentions he’s seeing reports of 40% of net revenue from webstores in some products.

Playtikka is widely respected for being more innovative in the adtech space, so let’s adjust this downwards and say roughly 15-20% of mobile game revenue is coming from webstores to get a gross mobile webstore revenue of around ~$20bln. The toolers take around ~10% (e.g. gross XSolla fees for monetisation support come to around 10.1%) of this so you’re left with a TAM of around ~$2bln.

That’s small. For perspective, venture-scale companies target $100M in revenue, so you’d need to capture 5% of that market. And you’re not just competing with other toolers but with the publishers themselves who may want to control all parts of the payment pipeline - i.e. the actual market available is even smaller.

The big two advantages these startups have is 1) it is easier to grab market share in a relatively new space where a lot of the best practice (particularly on how to connect in-app users to web-based stores whilst evading store fees) is not yet established and 2) you are banking on future growth.

Estimating Growth

To reason about said growth, let’s do a scenario analysis and plug in some assumptions. There’s three key variables to assume:

1, Mobile Game Revenue

Grows from $107.3bln (FY2023) to $143.1bln (FY2030F), a CAGR of 4.2% vs its past of 9.2% (2030 SensorTower forecasts)

2, Webstore Share of that Revenue:

Base: grows to 33% by 2030;

Bull: grows to 50% by 2030;

Black Swan: grows to 75% by 2030, Apple/Google are forced to drop restrictions.

3, Inflation

Returns to 2% target by 2026 (Federal Reserve Projections)

Note that I have assumed webstore’s share of total revenue will increase.

That’s because publishers have every incentive to nudge their biggest whales onto web stores. Given power law economics in whale spending (only ~3% of gamers will spend, of that 3% the top ~5% of spenders account for over half of revenue etc etc1), you don’t have to move that large an audience to shift the revenue share dial.

If cheap whale targeting methods cannot be re-established (questions marks over App’Lovin here and Apple showing early signs of backing off at least in fingerprinting), mobile is forced to move from an era of rapidly growing toplines with cheap UA whale-targeting to an era of incumbents protecting their margins by nudging in-app whales onto webstores.

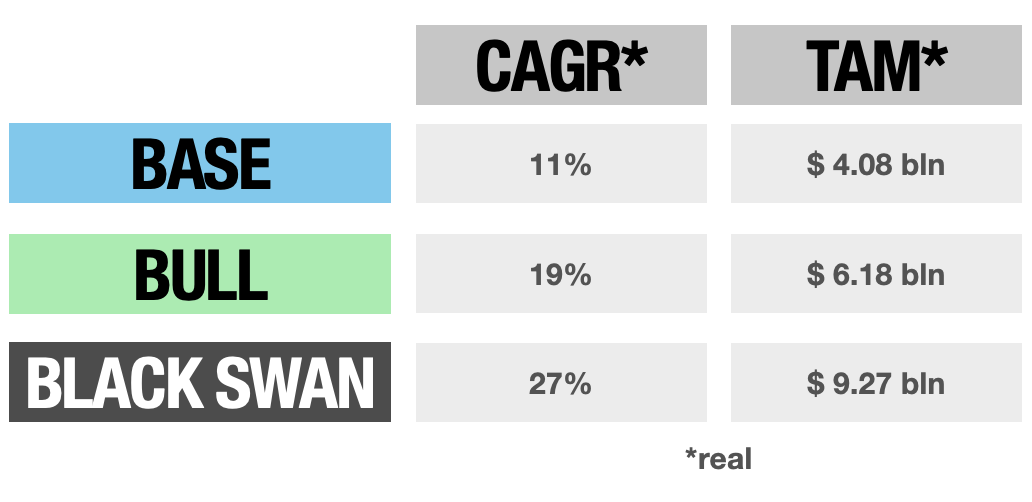

Plugging in these assumptions (spreadsheet link), you get the following real market sizes (i.e. the TAM in 2030 but in 2024 $ terms) and real growth estimates:

You get a market that grows rapidly but remains small in level terms. Even in the black swan case of anti-trust Apple/Google regulation that gifts webstores a 75% share of mobile revenue, the real market size stays shy of $10bln.

Because mobile gaming’s forecasted revenue growth has slowed to 4.2% and because the precise appeal of webstore tooling is that it extracts a far lower fee than 30%, even when you double/triple the share of revenue that webstores capture, it doesn’t move the webstore tooling TAM needle all that much.

Therefore, webstore B2Bs still find themselves needing to acquire a hefty 2-4% share of this TAM to reach venture scale. This is not a bonanza market, it’s going to be captured by a few players with a clear edge to corner it.

Webstore tooling is the beachhead, but a marketing platform is the goal.

“At Benchmark, we ask ourselves: ‘what could go right’”?

- Mitch Lasky

It’s all well and good talking about the numbers for web shops, but it fails to understand the meta-game in play.

In gaming, the most important feedback loops are created by ‘platforms.’ By creating a solution where the aggregate economic (or, arguably, social) use of third party users exceeds that of the first party, you grow enterprise value with some combination of network effects, switching costs and/or scale economies.

A large part of the opportunity in webstore tooling is how it ties into broader outreach and monetisation activities. For toolers, webstores will become a beachhead to aggregate publishers seeking aid with monetisation into their ecosystem.

As discussed, if you can corner that market, it’s enough to build a venture-scale company. But to build a unicorn, the key challenge will be leveraging that aggregated audience to become a marketing platform.

Web shop tooling will not be *the* strategy, but will rather be part of an overall one - becoming integral to mobile publishing’s “direct to consumer strategy”:

“Xsolla Mall unlocks a new direct-to-consumer distribution channel.”

- Chris Hewish, CEO of Xsolla2

“The era of direct-to-consumer for mobile games is here.”

- Andrew Dubatowka, Sanlo3

“Aghanim has built a direct-to-consumer platform that enables mobile game developers to create web-based game hubs”

- Constantin Andry, Aghanim (ex-Xsolla)

Becoming a marketing platform is the game behind the game. Play out the key steps:

1, Attract mobile publishers

Elegant solutions/tooling to replace in-app store fees with lower webstore fees is the arbitrage to attract publishers.

2, Monetisation and distribution in gaming are two sides of the same coin.

If X app wants to monetise itself, the easiest connection is with Y app that wants to find a user (because X has an audience that Y wants to reach, e.g. with ads). Whenever you have aggregated one group, you have a set of pre-qualified users that attract the other.

Web shops aggregate the most engaged, most monetisable audience because it already filters for those that fall into the ‘3% that pay’ category. Above all else, it will be solutions to reach - and information about - this audience that web shop toolers will seek to monetise.

3, The real value becomes the data generated from webstores

Webstore toolers are already proposing ad solution upsells that “propose monetisation offers” or tools that integrate offerings with streamers using xyz AI tooling.4

The ability to collect insights from the various webstores being hosted will be key to improving the UA/monetisation solutions that attract publishers, re-spinning the fly-wheel.

Mice-Nuts vs There’s something vital here

Before joining the world of venture, I examined public companies at a hedge fund.

The public markets perspective for a tooler would be that the addresable market for web shop tooling is too small to move the needle on your topline from existing solutions given the comparable TAM from, say, mobile ad spend.

But the venture perspective is far more exciting. You’re really asking yourself two questions to craft a venture thesis for a market:

Is the TAM large enough in my base case scenario to hit venture scale. Yes, but only for the few that can corner this rapidly growing, but small, market.

‘What could go right?’ Web shop tooling is the arbitrage to begin aggregating publishers into a tooling ecosystem. The real value is in leveraging that audience to build out a marketing platform.

To put it crudely, those mice-nuts have the potential to become marketing daddy-nuts - and positive skew is what venture startups are all about.

“Whiteout Survival’s $400M loot” - Deconstructor of Fun