Updates on AI, UGC and Web3 (ft. London Developer Conference)

Pregeneration using gen AI tools is the core trend but distribution innovation is the key investment opportunity. Meanwhile, CCP's attempt to merge UGC/Web3 hinges on its go-to-market.

Gaming Developers are mainly using Gen AI as a bootstrapped development tool

The gaming startup equivalent of Godwin’s Law is that ‘as a startup pitch progresses, the likelihood of claiming a tangential use case for AI increases.’

“Four years ago if I said I was doing video game AI, everyone remotely connected knew what I meant. Now, not so much.”

— Matthew Jack, CEO of Kythera AI1

AI has been deployed in the gaming industry for decades, but it has primarily leveraged ‘Game AI’ - a broad set of algorithms that have focused on a) managing NPCs (think behaviour trees governing the sequence of NPC actions or navigation meshes to determine pathing) and b) creating the game’s world (think procedural generation to create the Manhattan cityscape and facilitate realistic web-swinging in Insomniac’s Spiderman).

It is important to distinguish between Game AI - algorithms to create content that can be continously tweaked alongside the highly iterative development process of studios - and generative AI, the subset of deep learning that most observers are referring to when they write about ‘AI changing X industry’.

In the LDC developer panel discussion on AI, the panellists delved into why adoption of generative AI in game development remains limited (at least compared to other verticals). Three core themes cropped up:

Most gen AI tools for games are not good enough, failing to adapt to production workflows. Many of the asset creation tools don’t generalise well to game development - e.g. most generative image outputs are PNGs still. High quality tools for automated UV for navigation meshes is a recurring demand

Fear of the legal/copyright/ethical ambiguity. In a recent survey of game developers (sample size of ~34 so don’t read into any statistical signficance), 1 in 5 reported their studio “forbidding the use of generative AI”, largely “due to the dubious legal situation.”2 The construction of data sets without artists’ consent and the lack of clear divisible copyright complicates the release of any game built on such tools.

Developer concerns over being tied into unreliable & costly software licenses, e.g. Stability AI running out of cash to pay for the AWS rented compute to power their generative AI models.

The panellists agreed that the core use case is pregeneration. From needing to quickly put up a moodboard or throw together a quick first-pass at the physics/mechanics to then ‘find the fun’, all the way to identifying the optimal blend points for animations after generating keyframes, the overwhelming Gen AI use case is as a bootstrapped development tool that does a quicker, rougher first-pass soon to be passed onto human actors.

A great deal of hullabaloo was generated from InWorld Origins and Ubisoft’s NEO at GDC. I have seen many-a-blog discussing their experiences with smart-NPCs and I remain sceptical. Where is the TAM? The performance budget for AI characters has not markedly increased, and it is unclear where that will come from given the industry’s renewed focus on bringing operating costs down.

Indeed, gaming’s cost crisis is a further impulse for the pregeneration trend - improvements in productivity are valuable precisely because they improve the relationship between output and cost.

Getting the first pass of a build is often the most frustrating, timely (and therefore, costly) part of any creative endeavor. After that, the human expert takes over and iterates repeatedly - the creators’ fingerprints become so thoroughly embedded that it becomes unrecognizable as something AI initially generated.

A view on the major investment opportunities in Gaming / AI space going forward

Sadly, just because something is an exciting development in gaming, it does not necessarily make a worthwhile venture investment.

Gaming venture seeks out the founders and ideas capable of creating a $100m revenue company. To IPO, that revenue often needs to be growing at 50% YoY. The companies commanding premium exit multiples in acquisitions are those that do something novel consumers want and incumbents are struggling with.

It is in that light that we should assess the core three generative AI opportunities in gaming:

Easier Workflows - Build faster with smaller teams (discussed above)

New Game Experiences - New content formats enabled by AI (e.g. fully reactive/adaptive open worlds).

New Distribution methods - new ad formats, new ad content, improved audience targeting.

On (1), this is a core trend, but my nervousness stems from the size of the market. It is immensely difficult to build a high-scale business reliant solely on a model of B2B tech solutions (e.g. infrastructure, tooling, content moderation) for studios.

Developers are notoriously economical clients and love to build things themselves. On one hand you have the Indie developers who will buy nothing, and on the other, you have the ‘AAA’ studios who want to own every part of the production stack. Very quickly your bottoms-up forecasts of no. customers x average revenue per customer become shaky.

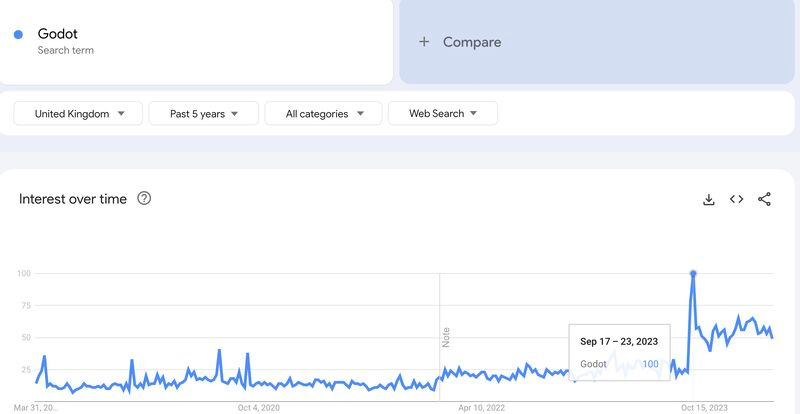

Recall that infrastructure giants Epic and Unity derive the lion-share of their revenues from a game (Fortnite) or advertising (Unity Grow). This is because gaming infrastructure/tooling lacks a purchase premium - recall how Unity’s recent attempt in September to push up fees resulted in widespread switching to the Godot Engine (open source).

The opportunity in building B2B productivity-enhancing AI tools is 1) largely reliant on building a solution that incumbents need to acquire, 2) having a broader consumer-sector base, or 3) transitioning into a more durable competitive advantage. Without (2) or (3), I doubt that Gen AI productivty solutions will build the next great public gaming company.

On the second core opportunity (“New Game Experiences”), I am immensely excited about living in a world where games adapt to you. One startup that has caught my eye is BitMagic (Sisu Game Ventures portfolio company). I’ve enjoyed playing around in the early release, creating my own worlds and quests from text prompts (e.g. I’ve started making the Shattered Plains and its war-camps from my favourite book series The Stormlight Archives).

This technology is a game-changer for UGC. The ability to generate fun in-game experiences without a coding background has profound implications for Roblox, Fortnite and other actors seeking to transition a product into an in-game platform that attracts a new demographic of no-code developers.

However, to succeed, you have to really believe you have a huge edge. This is an oversubscribed, immensely competitive field - one where incumbent game studios and publishers are at a substantial R&D advantage and have every incentive to bring this in-house.

Which leads me to my core belief; that investors talk way too much about (1) and (2) at the expense of (3) - New Distribution Methods. This partially stems from PC/Console’s conversational pull over that of mobile - though most gamers are mobile players and 3/4 of gaming’s growth the last decade has come from mobile, most ‘gamers’ are PC/Console players.

“Content innovation builds audiences. Distribution innovation builds enterprise value.” — Mitch Lasky

One of the most important laws in mobile is that if your LTV is higher than your CAC you have a viable product, if not, a side-hobby. E.g. Monopoly Go’s monetization rate allows it to drive its competitors out the park with $500m of UA spend (that, and board game IPs being woefully under-utilised to date).

This equation has determined a mobile game’s success. And right now, mobile is in a distribution crisis that needs solving with privacy changes driving up CACs.4

AI distribution tools that better enable hyper-targeting, new ad formats and content began popping up in late 2023. One example is Reforged Labs (recently raised $2mn from Y Combinator). You can upload your assets, describe a video ad you’d like to create with a text prompt and produce high-quality, on-brand video assets across your major marketing channels. From there, there is the standard offering of self-improving models to analyze and iterate on campaigns.

Gen AI Tools that optimise gaming mobile marketing have the additional benefit of likely finding uses in the broader consumer app market.

In an earlier post, I spoke of how the timeless pattern in building remarkable gaming companies is using a distributional arbitrage to build an aggregated audience into some type of ‘platform’ that entrenches value through some combination of network effects, scale economies and switching costs.

New Gen AI ad solutions are exciting because they naturally scale into platforms:

Attract publishers seeking to optimise UA spend with a Gen-AI ad-solution offering → leverage users’ ads to train ad optimisation models → repeat / bring in apps seeking monetisation to expand into a two-sided network / expand into consumer sectors.

Eve Online Combines UGC with Web3

The London Developer Conference also provided a clearer glimpse of Project Awakening, the ‘AAA’ game developed by CCP (Eve Online) and backed ($40m in March 2023) by Andreesan Horowitz.

I have been curious about Project Awakening ever since the project was announced with the following techno-babble:

“Composability and programmability will enable players to build and collaborate on top, outside and within the emergent game environment - unlocking boundless creativity for third-party development via blockchain technology.”

There is enough here to make that professional LinkedIn influencer quake violently with pleasure and need a cold shower afterwards. But yes, it looks like there will a UGC model of developers making in-game experiences alongside a tokenized in-game currency. Some thoughts:

Note that UGC has so far proven highly anchored to the platform’s genre-ecosystem. >90% of games on UEFN are FPSs, but <10% on Roblox. This is because in-game platforms combine pre-qualified userbases with a game engine (i.e. you started playing Fortnite because you liked FPSs and it is hard to develop FPSs in Roblox’s engine). As of now they don’t really compete5, which makes it all the more urgent for existing popular titles in untapped genres (e.g. sci-fi MMOs) to develop in-game platforms.

This is clearly the focus of the “Phase III Hackathon” starting in May 21, explicitly pitched to game developers at LDC to begin programming in-game experiences and inviting the most promising teams back to Reykjavík. Clearly the idea is to build the platform alongside the very developers that would make it succesful.

“[We are] making [Eve Online’s] Carbon Development Platform open source, allowing programmers and game developers to access the Carbon game engine framework… for free.”

Note, also, that Eve Online is the industry’s longest-running succesful metaverse with a well-managed virtual currency. The biggest Player Corporations (think guilds), Goonswam Federation and Test Alliance Please Ignore have their own wikis, apps and IT departments. The average EVE player sits on a mean asset base of $1.2K (the mean American has $500 in their bank account) and the highly liquid grey market has already led many detractors to wrly remark that Eve is more of a job than a game for many of its players.

Of course, CCP doesn’t see a dime in that grey market. Enter the “new single shard survival [space-exploration] experience”, Project Awakening. You know what game is also a multiplayer single-shard, survival, space-exploration experience? Eve Online.

The main argument of Hilmar Pétursson at the conference was ‘who better understands the challenges of maintaining a metaverse.’ CCP has already had to grapple with one of the key web3 stumbling blocks, namely, the management of an in-game currency.

A web3 native approach involves a game design that, at its core, is constantly vigiliant in balancing demand with supply.

On demand, the core issue with much of web3 to date is the failure to realise that pay-to-earn is meaningless if nobody other than speculators wants to buy (and then spend) the currency. If the only reason to buy the token is the belief that it will appreciate, you have created a ponzi scheme not a gaming company.

One of Luke Barwikowski’s (founder of new web3 runaway Pixels Online) most important and underrated insights is the observation that “the real goal is net Pixels spend in the long-run.”6

If players desire the currency to game, then the currency has intrinsic value. That anchor stabilises the currency, which makes the in-game sacrifices to earn it meaningful whilst securing long-term interest in your financial asset. Build a web3 game for gamers, and speculators will follow. Build it for speculators, and you’ll join the web3 gaming graveyard.

On supply, the universal rule of gaming is that any loophole/chink will be ruthlessly exploited, breaking the game’s balance - the pay-to-earn model commits a company to a perpetual, costly and high-stakes arms race against botting.

An Eve Web3 project is interesting because it is difficult to think of a studio that has spent more time grappling with currency management, this delicate balance of supply and demand, than CCP.

But that’s not the most important point, here. Recall from an earlier post that platforms in gaming have typically been built by leveraging an already-aggregated user base. If Valve were to convert CSGO’s items and skins into NFTs and issued a token to trade them, it would become web3 gaming’s greatest success overnight.

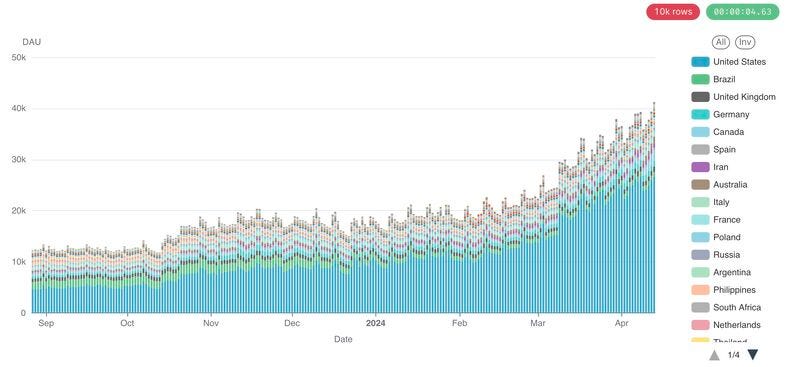

One of web3’s greatest challenges is that typical distribution methods have been closed off (e.g. Steam’s web3 ban in 2021). That’s pushed the need to use web3 native distributional methods like partnering with Yield Guild Games or leveraging the Mavis Hub. But the reach using such methods pales in comparison to web2 platforms, and helps explain why global web3 DAUs have struggled to exceeed 20K DAU (per geography) for much of the recent past.

This challenge is also web3’s greatest opportunity. The fact that major publishers and developers have stepped out of the space creates the opportunity for a new player to establish a dominant platform.

Project Awakening’s greatest advantage is Eve Online’s existing user base. It is set in the Eve universe which already has a highly dedicated user base that loves single-shard survival space-exploration, which begs the question: why isn’t it just called Eve 2.0?

Here, we glimpse the greatest danger. Pétursson’s speech about “megatrends” was the standard ‘many don’t have jobs. Those that do don’t like them. Wouldn’t it be great if you could earn doing something you love.’ Though everything here screams “pay to earn”, that remained the phrase-that-must-not-be-named.

The nightmare scenario for CCP is as follows. They have built the perfect project to attract venture capital, but the key question mark is its reception amongst the Eve core playerbase (currently looking luke-warm at best, though admittedly, the YouTube comment section is not exactly a great bastion for thoughtful debate).

That is the key challenge. If they can win their community over, like Riot won over the Defense of the Ancients community to launch League of Legends, this could prove web3’s great breakthrough.

Community determines longevity. Win over the Eve community and this game will win web3. Fail to do so and one year from now pundits will be covering yet another story of a ‘gamer backlash against corporate greed’ . Go-to-market is everything here.

My bet is that they fail at this step, but I would be happy to be proven wrong.

“Your Thoughts on Generative AI for games” - Tommy Thompson

Ibid

“The Tremendous Yet Troubled State of Gaming” - Matthew Ball

David Taylor on LinkedIn, Naavik “State of UGC” and Naavik Podcast “Lessons in Pioneering new platforms.”

Twitter/X Post - Luke Barikowski

“Big Blockchain Game Report, Q1 2024” - Jon Jordan