1. On Games Workshop - What Space Marine 2 means for GW's earnings

Something doesn't smell right about GW's share price...

At this year’s Gamescom, I was one of the schmuks who spent upwards of an hour queueing to play the demo of Saber Interactive’s Space Marine 2.

I’ve followed the title closely since early August, being a true man of culture who spams consultants/analysts with titles of interest:

I really enjoyed the demo, so I’m not surprised it’s doing well. As of 11th September it has sold 2m units. Its peak CCU on Steam is 225,690 (for perspective, Helldivers 2 peaked at 458,709, though Space Marine 2 costs more) and is the #1 seller:

Estimating Games Workshop’s Licensing Revenue from Space Marine 2

Joost Van Dreunen’s most recent newsletter estimated that Space Marine 2’s gross revenue comes in at a substantial sum of $202m.2

That’s a big chunk of cheese, but what is Games Workshop’s cut? I was recently chatting with an Indie developer whose team had previously made a PC game set in the 40K universe. He told me two things about GW licensing:

They were paying a 35% fee to Games Workshop after the 30% storefront fee to Steam (hence the desire to make their own IP title);

The fee was taken after Steam but before the publisher’s cut: Steam » Games Workshop » Publisher » Developer;

The real licensing fee for Space Marine 2 is likely below this, given the degree of risk Saber Interactive was taking on for this larger project. At this scale, licensing fees typically sit between 10% and 25% for the most-commanding IPs. Given GW had the luxury of cherry-picking the studio to develop this second installment and Warhammer’s growing strength of an IP, a figure of roughly 15-20% seems plausible.

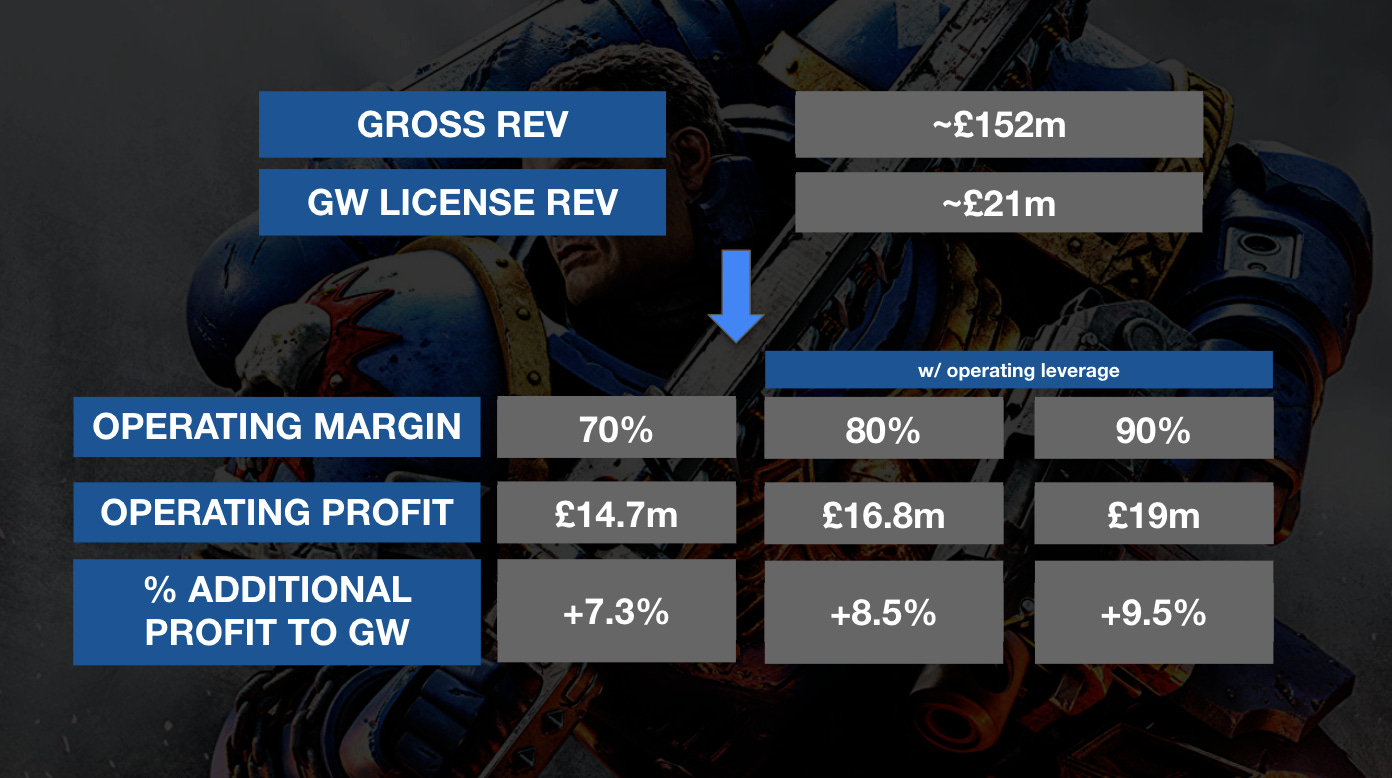

From this, we can construct an estimates for GW’s licensing revenue, profit and circle that back to Games Workshop’s share price:

We can roughly estimate GW’s licensing revenue (all calcs in £ because GW reports in GBP) from Space Marine 2:

Very roughly, if Steam takes 30% of gross (~£152m - £46m) leaving us with £105m and then GW takes a 20% fee you are left with around £21m. This is crude (there’s also refunds pre-Steam’s cut and sales tax after Steam’s which reduce this figure further), but whether it’s £15m or £21m the ballpark point stands - this is a singular title returning +50% on top of their existing licensing revenue.

Also note that as a share of GW’s core revenue (the miniatures business model) it’s still small. However, the core strength of licensing isn’t its impact to the topline, its the high degree to which it flows through to profitability.

License Fee Profitability from Operating Leverage

Jen Donohue and others have repeatedly spoke of the strength of the licensing model because it’s effectively free money that goes straight to the bottom life as you aren’t bearing the costs of bringing that IP to life. We recently saw this kind of story with Monopoly Go’s impact on Hasbro’s income statements.

Though licensing revenue is less than 1/10th GW’s core revenue, it is important to GW’s profitability because it has far lower costs than other revenue segments.

*, 4

GW licensing revenue has an insanely high operating margin of 87%, i.e. an increase in licensing revenue heavily through to operating profit. From the annual report:

“[In 2023] there was a 7m increase in licensing revenue whilst licensing operating profit increased by 5m.”5 [71% operating margin on newly created licensing revenue]

Though 1/10th of sales growth came from licensing (7m/70m), 1/5th of operating profit growth (5/26m) came from licensing.

This is effectively an operating leverage point, a fancy way of saying ‘many of the costs are fixed and don’t rise in-line with sales, so when sales increase, your margins grow and you become even more profitable.’

Basically, GW requires “specialist IP and licensing teams to work closely together to ensure IP correctness and consistency” and also suffers “costs related to using the IP created in the core business [selling miniatures].”6 So, whether Space Marine II sells bonanzas or completely flops, GW still has to pay those teams to manage its IP-properties, and it’s unlikely they hire loads more when Space Marine 2 succeeds.

So when a game does go bananas, those sales become subject to lower and lower costs as a ratio of sales… operating profit goes brr.

So what does Space Marine 2 mean for GW’s earnings and share price?

“When the facts change, I change my mind - what do you do, sir?”

John Maynard Keynes

One of the more entertaining exercises in life is reasoning whether a given share price movement after new fundamental news breaks is an under or over-reaction. As of writing this piece, GW’s share price has climbed 4.6% since Space Marine 2’s release:

My personal view is that this is an under-reaction. Why? A quick cut-through is to observe that a stock’s increase in price can mechanically come from two factors:

An increase in the P/E multiple (i.e. investors pay more $ for each $ of earnings because they forecast increased earnings into the future), AND

An increase in earnings (i.e. because equity holders have a claim over those earnings).

These two work in tandem. Mechanically, a share price can stay the same even when earnings increase if investors believe said earnings came at the expense of future earnings (e.g. Price = Flat if P/E declines by 5%, EPS increases by 5%). But in GW’s case, that would be nonsensical. It would be silly for P/E to contract in the face of new evidence that GW can grow the highly lucrative licensing side of the business.

In this specific case, there is a real chance that Space Marine 2 can transition into a long-term live-service game with a recurring revenue stream - that is clearly Saber Interactive’s intention with its road map:

So, given the ‘new fact the market needs to process’ (Space Marine 2 releasing), P/E shoud not logically contract (if anything, it should increase). The success of Space Marine 2 will also bring new customers into the ‘core’ miniature business - it’s effectively free UA (though I have no evidence for this).

But if we examine this question on earnings from Space Marine 2 alone, if we assume a licensing operating margin in the range of 70% - 90% (given my discussion of operating leverage) then the game’s impact on earnings assuming £21m in licensing revenue is:

70% Operating Margin → £14.7m → +7.3% additional operating profit on the OVERALL business

80% Operating Margin → £16.8m → +8.5% additional operating profit

90% Operating Margin → £19m → +9.5% additional operating profit

That is seriously non-trivial for GW. Yes, I get that it’s a simplification… there’s a whole set of technical factors that govern share price and short-term price movements are always noisy.

But something doesn’t smell right. I’ve been reading sell-side reports on Games Workshop the last few days, all of whom mentioned ‘licensing revenue as a key factor to GW’s future earnings potential’ but not one grappled with the new IPs like Space Marine II that might determine said licensing revenue.

So part of me suspects this is a repeat of Nexxon’s Dungeon Fighter mobile release in China, whereby the market underestimated its impact to their bottom-line for several weeks due to a poor understanding of how Chinese game data doesn’t actually show up in public stats.

Is this another arbitrage where those paying closer attention to events unfolding in the video game landscape and processing its treasure-trove of data have an edge?

I suspect so, but let’s see if I’m right in GW’s next earnings call.

*, (31.0 instead of 32.8 of licensing revenue because the table before was in constant currency, hence the discrepancy)

https://steamdb.info/app/2183900/charts/

Ibid

Ibid

Ibid